Pan Aadhar Link Circular / How To Link Aadhar With Pan Card Online 2019 Tac Sandeep : Your some information already register there like date of birth, gender and name which is fetched by your pan details.

Pan Aadhar Link Circular / How To Link Aadhar With Pan Card Online 2019 Tac Sandeep : Your some information already register there like date of birth, gender and name which is fetched by your pan details.. The government extended the deadline of linking pan with aadhaar by nine months, i.e., from june 30, 2020, to march 31, 2021. D) a pop up window will appear, prompting you to link your pan with aadhaar. If individuals do link their aadhar and pan, they will get a penalty of 1000. Your some information already register there like date of birth, gender and name which is fetched by your pan details. The last date to link pan card with your aadhar card is march 31 and if it is not linked in the next three days, as per the finance bill 2021 passed in the parliament on wednesday, your pan card.

The government passed the finance bill 2021 in the lok sabha last week where it inserted a new section 234h under which a person. Importance of linking pan card with aadhaar card both the pan card as well as the aadhaar card are unique identification cards that serve as proof of identity that are necessary for registration and verification purposes. Tick the square if only your birth year is mentioned in your aadhaar card as the date of birth step 7: However, notwithstandingthe last date of linking of aadhaar number with pan being extended to 30.09.2019 in para 1 above, it is also made clear in circular no. However, the quoting of aadhaar card or enrolment id is only applicable for a person who is eligible to obtain aadhaar number.

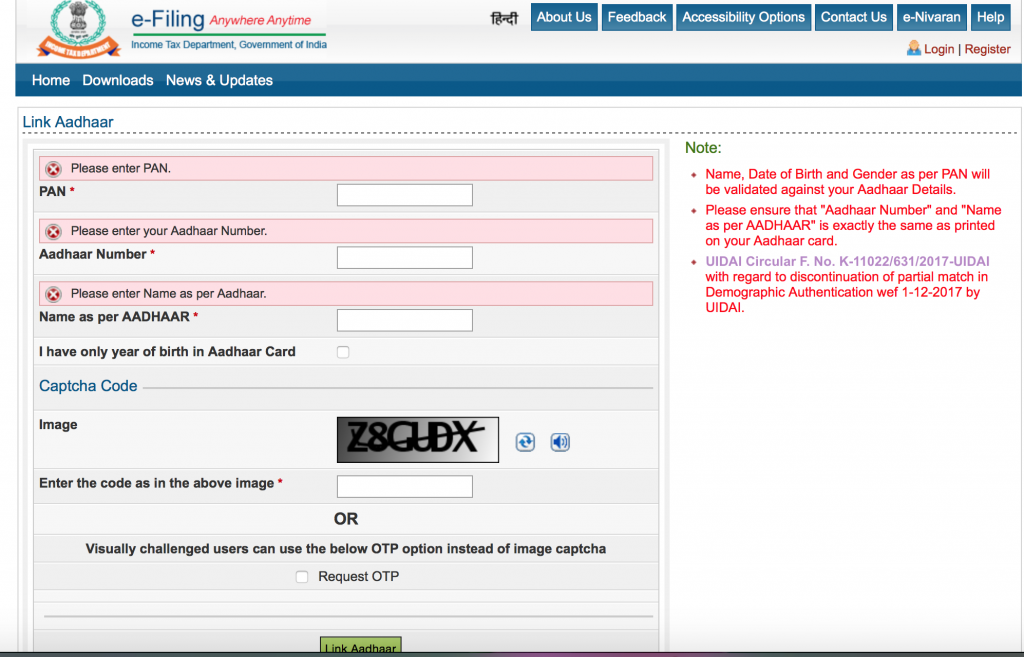

Here's how to link your pan with aadhar online.

The income tax department has released the official website to link the pan card to the aadhaar card. Moreover, if the pan card isn't linked to the. The visually challenged users can avail this facility by requesting got an otp instead. However, the quoting of aadhaar card or enrolment id is only applicable for a person who is eligible to obtain aadhaar number. Check the step by step procedure in this to link the pan card with the. For those who are yet to link their pan(pan card) with aadhaar, there is good news for them as the deadline has been extended till june 30. Aadhar link to pan card will help you to tackle the problem of multiple pan cards issued in the same name. The government extended the deadline of linking pan with aadhaar by nine months, i.e., from june 30, 2020, to march 31, 2021. According to the directive from the income tax department, it is obligatory to link your permanent account number (pan) with aadhaar. According to this new section, everyone has to link their aadhar card to their pan card. Click on the 'link aadhaar' option in the 'services' section step 3: The last date to link pan card with aadhaar card is extended from march 31, 2020, to june 30, 2020 due to the lockdown. If your pan is not linked with aadhaar your income tax return form would not be processed.

The government passed the finance bill 2021 in the lok sabha last week where it inserted a new section 234h under which a person. However, notwithstandingthe last date of linking of aadhaar number with pan being extended to 30.09.2019 in para 1 above, it is also made clear in circular no. Business 9 hours ago fuel prices slashed for 2nd time in 6 days, petrol in delhi costs rs. The government has urged all entities to link their pan cards with their aadhaar cards. If you are a taxpayer then for you it is more important to link because your income tax return form would not be processed if your pan card is not linked with aadhaar card.

The government has urged all entities to link their pan cards with their aadhaar cards.

However, the quoting of aadhaar card or enrolment id is only applicable for a person who is eligible to obtain aadhaar number. The deadline for linking permanent account number (pan) to aadhaar is just a couple of days away and if anyone fails to do it by wednesday, march 31, 2021, then their pan will become invalid. In case your pan dies become inoperative you do not have to worry because once you link your pan and aadhar, the pan becomes operative, and no penalties shall be applicable post the date of linking. However, if you use your pan card as an identity proof for purposes which are not related to tax such as opening a bank account, applying for a. E) details such as name date of birth and gender will already be mentioned as per the pan details. To link the aadhaar and pan you can send sms to 567678 or 56161. Check the step by step procedure in this to link the pan card with the. The user will get a concluded detail of taxes levied on him for future reference. According to a governmental circular issued earlier this year, any indian citizen who was issued a pan card on or before july 2017 is required to link the card to their aadhaar, which can be done. Input your aadhaar number step 5: The user who had linked aadhar card with pan card will get a summarised detail of taxes charged on him. The income tax department has released the official website to link the pan card to the aadhaar card. The government has urged all entities to link their pan cards with their aadhaar cards.

Now any person of the country can link their pan card to aadhaar card through an online portal. Enter your pan card number. For those who are yet to link their pan(pan card) with aadhaar, there is good news for them as the deadline has been extended till june 30. The user will get a concluded detail of taxes levied on him for future reference. The government passed the finance bill 2021 in the lok sabha last week where it inserted a new section 234h under which a person.

To link the aadhaar and pan you can send sms to 567678 or 56161.

Now any person of the country can link their pan card to aadhaar card through an online portal. However, if you use your pan card as an identity proof for purposes which are not related to tax such as opening a bank account, applying for a. Tick the square if only your birth year is mentioned in your aadhaar card as the date of birth step 7: If your pan is not linked with aadhaar your income tax return form would not be processed. To link the aadhaar and pan you can send sms to 567678 or 56161. Select an option of 'pan card updating', link your pan, update pan or similar relevant option. The government extended the deadline of linking pan with aadhaar by nine months, i.e., from june 30, 2020, to march 31, 2021. We hope this notification puts at rest all the confusion that was created by earlier orders and circulars. et.com had first pointed out this lack of clarity about whether pan would become invalid if not linked to aadhaar by the earlier deadline of march. Importance of linking pan card with aadhaar card both the pan card as well as the aadhaar card are unique identification cards that serve as proof of identity that are necessary for registration and verification purposes. Passed the finance bill, 2021 on thursday, a new amendment has created problems for the. Format to send an sms uidpan 343134211134 aaape12ee Not only this they may also be liable to pay a penalty of up to rs 1,000. The government passed the finance bill 2021 in the lok sabha last week where it inserted a new section 234h under which a person.

Komentar

Posting Komentar